Current Tax Code

Our current tax code is outdated, cumbersome, and extremely inefficient. Each year Congress adds exemptions, modifications, and rate adjustments to our tax code, which is now over 70,000 pages. Taxes are collected on individual’s income, corporations profits, estate taxes, social security tax, Medicare tax, self employment tax, just to name a few. To illustrate how inefficient our current system is, consider this. For every $1.00 that is collected, only $0.77 goes to the US Treasury. The other $0.23 cents is consumed in either waste or cost of compliance.

FairTax Summary

The FairTax is designed to collect the exact same revenue as today’s system. But, instead of having a jumbled set of hidden and penalizing taxes, we have one simply tax paid at the point of sale for new goods and services. In other words, under the FairTax their is no income tax, no social security tax, no estate tax, no corporate tax. The revenue the Federal Government needs is simply collected in an upfront and transparent sales tax on new goods and services.

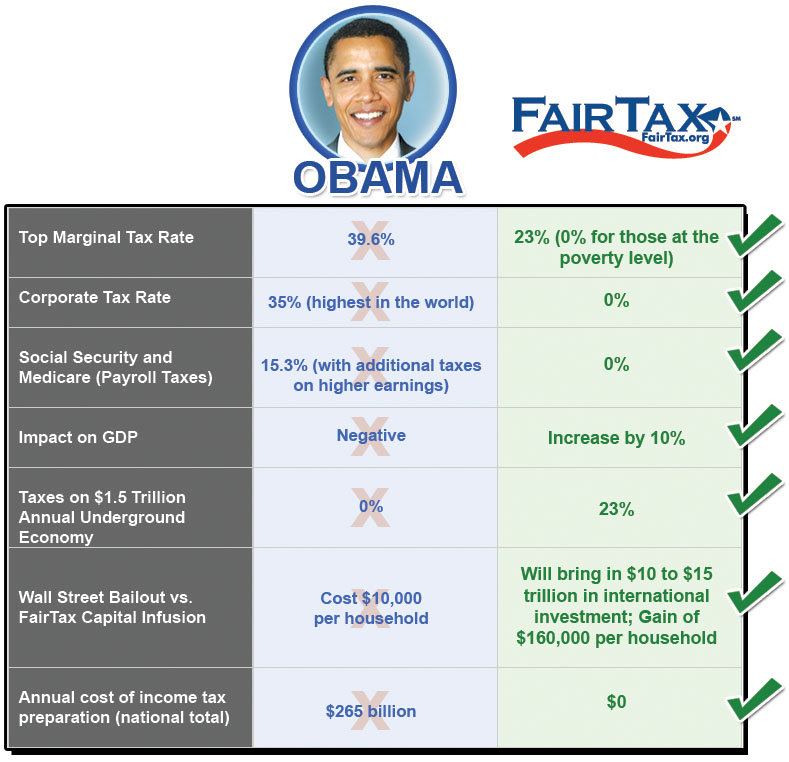

Presidential Tax Plans

There’s lots of talk about change, but let’s compare how much Obama’s tax plans would really stack up against the FairTax, a real agent of change.